Dallas real estate trends

“It’s The Housing, Stupid.” — What I hope someone writes on a wall somewhere in the White House. Now that there is a pay wall at the Dallas Morning News — I do subscribe — I will try and give you a weekly re-cap of real estate news and a look/see at what our local…

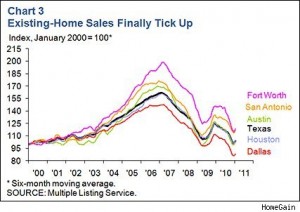

Read MoreI’m just going to say it: is this administration trying to KILL OFF the U.S. housing market? By now, if you are in the real estate business, you are thinking about serious drinking. Save the calories if you live in Dallas: we did OK. Not great, but OK. The S&P/Case-Shiller report says overall, the nation’s…

Read More