Second Homes and Taxes

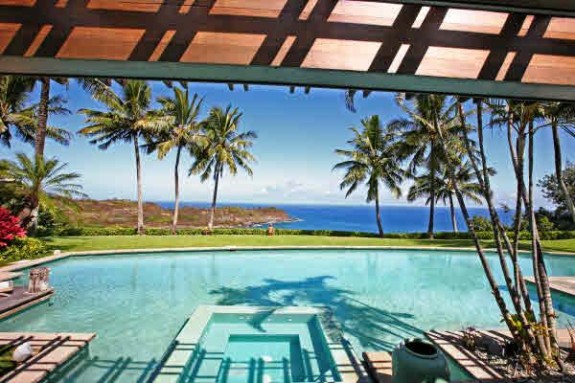

With the economy on the upswing, better interest rates, and stock market gains, vacation homes and second home purchases are booming. By the lake, in the mountains, near the cost, in the desert — there are tons of great locations with plenty of fantastic properties. And sometimes a second home can actually make you money.…

Read MoreWhat kind of nuts are we talking about, Jodi? Macadamia nuts? Brazil nuts? Definitely not peanuts, as you won’t find any vacation homes worth their salt going for that. Sure, the second home market is super hot, but let’s not get too carried away — slow growth is sustainable growth, and that’s what many economists…

Read MoreWith rates falling as they have over the past few years, a lot of people refinanced their homes and investment properties. And yet, rates keep falling to historic lows. Does it make sense to refinance again? I recently spoke to Marcus McCue, Senior Vice President of Guardian Mortgage Company about my own situation with an investment property…

Read More