Second Home Demographics

What kind of nuts are we talking about, Jodi? Macadamia nuts? Brazil nuts? Definitely not peanuts, as you won’t find any vacation homes worth their salt going for that. Sure, the second home market is super hot, but let’s not get too carried away — slow growth is sustainable growth, and that’s what many economists…

Read MoreI caught up with Vern Yip, star of HGTV’s way popular design shows, when he popped in to visit I.O. Metro up near the Dallas Galleria last week. Yip has a new partnership with the Little Rock, Arkansas-based store that offers a wide variety of stylish, sleek but hip, good-looking and comfortable home furnishings at…

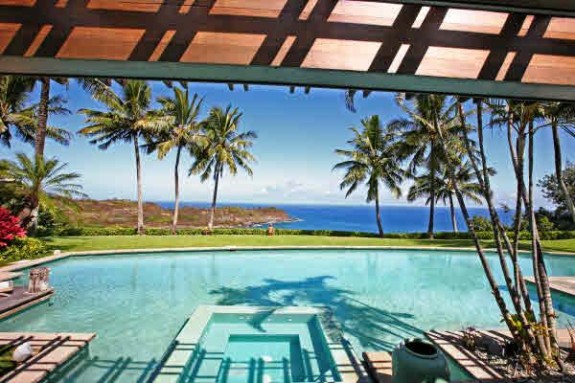

Read MoreI feel like some House Porn Candy (I’m trying to go on a diet and stick with Candy instead of Porn) and when I saw this home at gorgeous Cinnamon Shore last weekend, I seriously said — I’m selling everything and moving in. Squatters rights, whatever. What is it about being at the beach that…

Read More